Consumer trends of Ukrainians in the third year of the great war

What changes are Ukrainian consumers being pushed to make by a long life in an indefinite war? Gradus Research has completed an extensive study of consumer trends in Ukraine and identified several important trends.

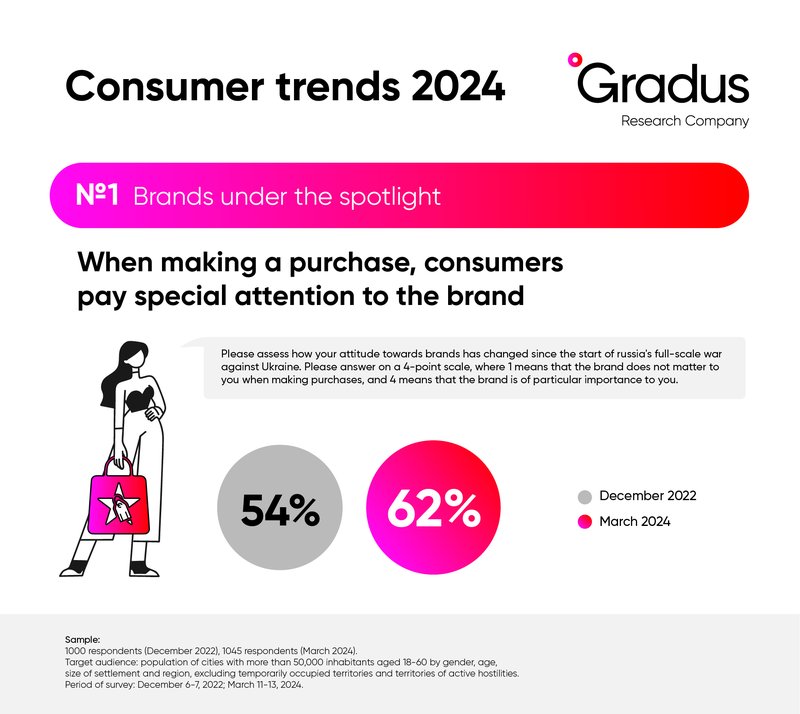

Brands under scrutiny

The attitude of Ukrainian consumers towards brands remains quite picky. Two-thirds of respondents (62%) pay special attention to the brand when making purchases, while in December 2022 the number was just over half (54%). At the same time, consumers in large cities are more picky, which may be explained by the wider choice of goods or services there.

Place in the sun for Ukrainian brand

The desire to support Ukrainian producers is an important factor in the choice. The survey data shows that Ukrainian consumers are quite cautious about changing their usual brands. More than half of respondents (54%) prefer familiar brands. However, there is a strong demand in the market to try new brands as 37% of respondents are ready to experiment. And the key factor that motivates people to give new brands a chance is the desire to support Ukrainian products (57%). The second factor is cost savings (45%). At the same time, women tend to favor the first, more emotional driver, while men tend to favor the second, more rational one.

This converts into a growing preference for Ukrainian brands over foreign ones. While in December 2022, the trend was only gaining momentum, with 69% of respondents stating that they would buy goods/services from Ukrainian producers, the share of such respondents has now increased to 74%.

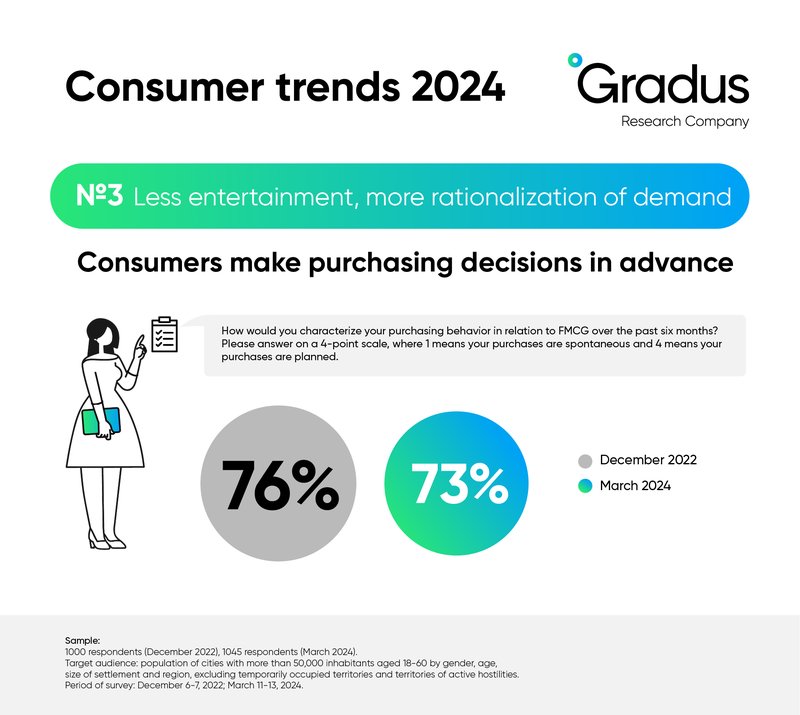

Less entertainment, more rationalization of demand

Ukrainian consumers are saving money. Two-thirds of respondents (65%) prefer cheaper brands.

One third of respondents (32%) refused to buy their favorite brands.

Food and medicines remain at the top of consumption, and these are the categories on which people save the least. Also, education and transportation/fuel costs are the least affected by budget cuts.

At the same time, respondents tend to cut spending on nonessential goods. More details about the categories where expenses are being cut can be found in the full survey report.

The majority of respondents continue to plan their purchases in advance (73%) rather than make spontaneous decisions.

"We see even greater rationalization of consumption and a growing preference for Ukrainian producers. These are natural processes, because they were preceded by the citizens' realization of the long marathon of the war, and, accordingly, the savings rate is growing. But it's not the price factor that comes first, it's the desire to support Ukrainian products," says Evgeniya Bliznyuk, sociologist, founder and director of Gradus Research.

"A year ago, we studied the attitude towards foreign manufacturers in various European countries, and all of them were characterized by a high preference for local brands. Now we see this trend in Ukraine as well," says the expert.

The survey was conducted by Gradus Research using a self-administered questionnaire in a mobile application. The Gradus online panel reflects the population structure of cities with more than 50,000 inhabitants aged 18-60 by gender, age, settlement size and region, excluding temporarily occupied territories and territories of active hostilities. Period of the field: March 11-13, 2024. Sample size: 1045 respondents.

Other reports

-

Довіра до підприємців в Україні: кого підтримує суспільство під час війниJuly 2025Спеціальне опитування для Forbes Ukraine щодо ставлення бізнесменів

Довіра до підприємців в Україні: кого підтримує суспільство під час війниJuly 2025Спеціальне опитування для Forbes Ukraine щодо ставлення бізнесменів -

Life Quality Barometer 2025July 2025Joint study with EBA on the impact of full-scale war

Life Quality Barometer 2025July 2025Joint study with EBA on the impact of full-scale war -

Wartime survey of Ukrainian society / twelfth waveJune 2025Ukrainians are exhausted but not discouraged: results of the 12th wave of the Gradus Research survey

Wartime survey of Ukrainian society / twelfth waveJune 2025Ukrainians are exhausted but not discouraged: results of the 12th wave of the Gradus Research survey -

Expectations from employers in a situation of total burnoutMay 2025Special HR survey of expectations from employers and the level of burnout among Ukrainians

Expectations from employers in a situation of total burnoutMay 2025Special HR survey of expectations from employers and the level of burnout among Ukrainians