How are startups developing in Ukraine during the war?

"The birth rate among startups is higher than among businesses

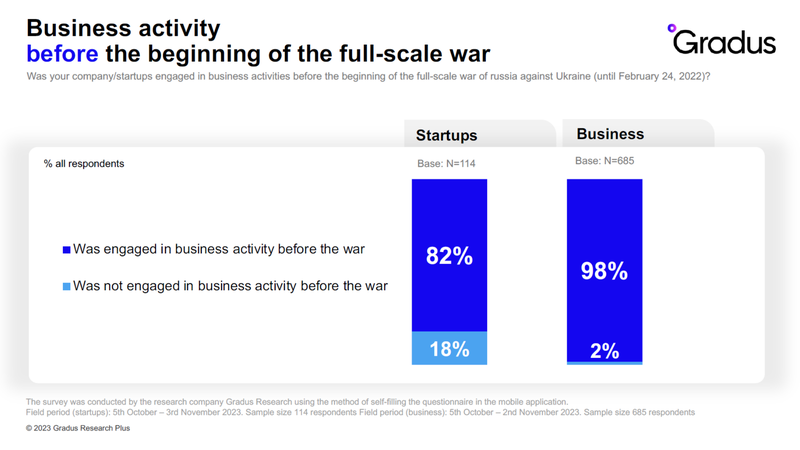

According to the study, 18% of the surveyed startups started their operations since the beginning of the full-scale war, compared to 2% of traditional businesses in Ukraine. This may be due to the fact that in times of crisis, it is more difficult for traditional Ukrainian businesses to generate ideas and implement new projects compared to startups.

As for the status of their business, 31% of the surveyed representatives of the startup community and 39% of traditional businesses that started their operations before the war claim that they are currently partially operational. This indicates that both startups and businesses in Ukraine have not yet reached their full pre-war potential.

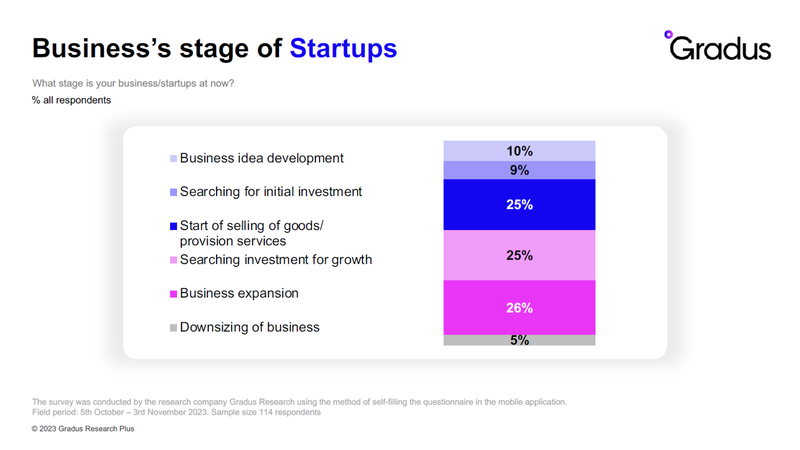

The vast majority of Ukrainian startups are in pre-seed status

The survey results show that 69% of the surveyed Ukrainian startups are at the initial stage of development (pre-seed). Thus, 10% are currently involved in the formation of a business idea, 9% are looking for initial investment, 25% have started selling goods or providing services, and 25% are trying to attract investment for growth

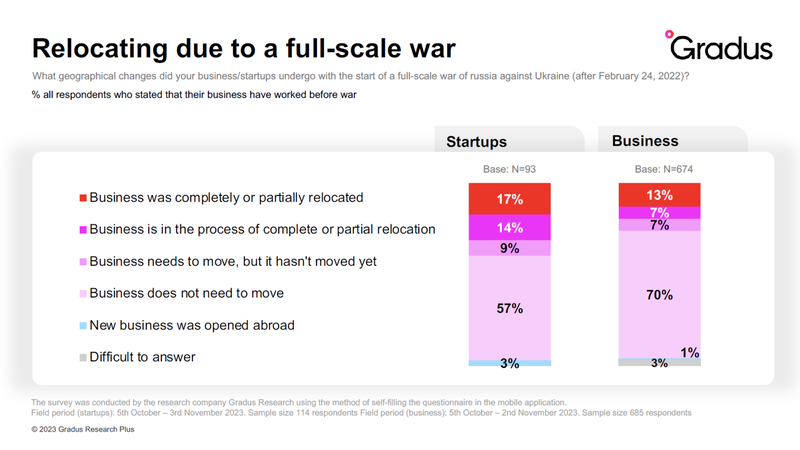

Startups are relocating more actively, but the bulk of them remain in Ukraine

17% of the surveyed startups have moved their operations partially or completely abroad, compared to 13% of the surveyed representatives of traditional businesses. Instead, 57% of startups and 70% of businesses said that there was no need to relocate at the moment.

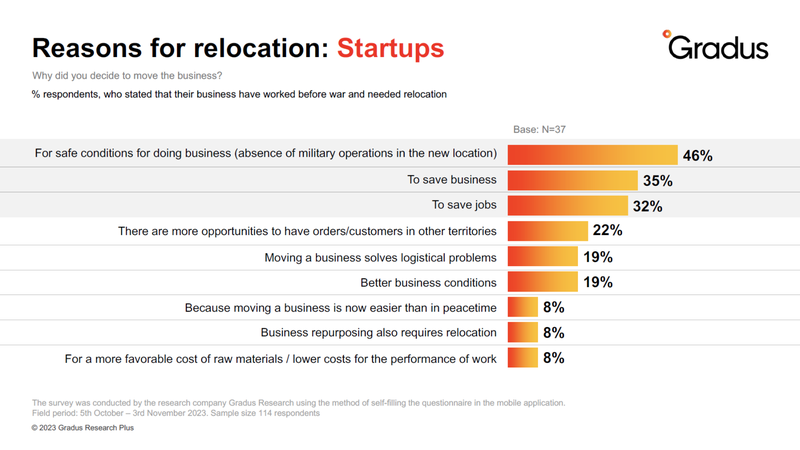

The purpose of startups' relocation is to save jobs and find new markets

The survey results show that for 46% of the surveyed startup representatives, the main reason for relocation is safe working conditions. 35% of respondents said they needed to relocate to save their business, and 32% said they needed to save their jobs. The main motivation is the same for traditional Ukrainian businesses (34% - for security reasons, 31% - to save the business).

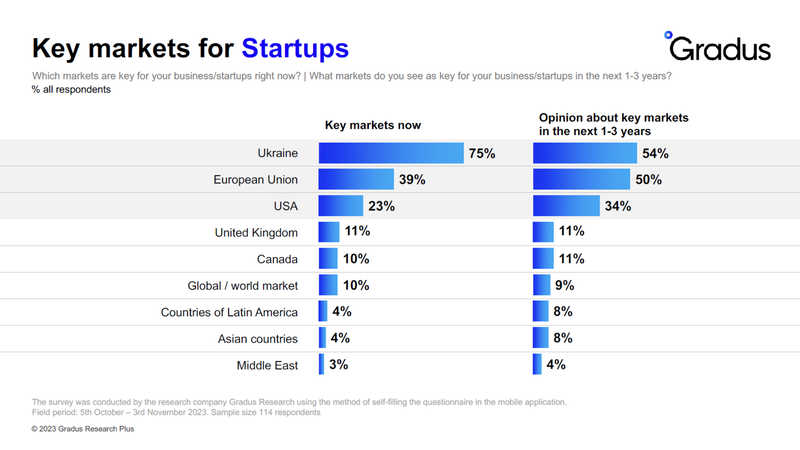

Ukraine remains the key market for Ukrainian startups and traditional businesses

Ukraine is the main market for 75% of surveyed startups. The European Union is the main market for 39% of the surveyed representatives of young Ukrainian companies, and the United States - for 23%. If we look at the intentions of startups for the next three to five years, the importance of the European Union and the United States as target markets increases.

For Ukrainian businesses, Ukraine also remains a key market (for 82% of respondents). The main reasons for focusing on Ukraine are the place of residence (54%) and the demand for products/services (48%). Poland and Germany also play an important role (41% - Poland, 29% - Germany) in the plans of Ukrainian businesses, for which the EU market is currently the key market. The share of respondents who plan to focus their efforts on the markets of Poland (45%) and Germany (32%) is gradually increasing.

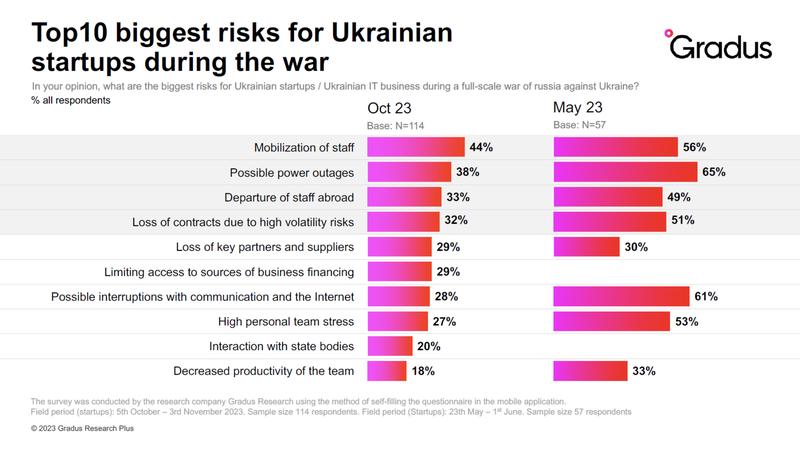

Infrastructure risks and team remain at the top of the list

Infrastructure risks and the team remain at the top of the list of risks. A survey conducted among Ukrainian IT startups in May 2023 showed that the main risks were related to electricity (65%) and Internet infrastructure (61% of respondents). This result may be due to the fact that the survey was conducted immediately after a period of active power outages. Currently, the main threat, according to the surveyed representatives of the startup community, is the mobilization of personnel (44%).

For 38% of the surveyed startups, possible problems with electricity remain the main risk, as companies expect possible blackouts, and as a result, the market fears the loss of contracts. After all, 75% of respondents said that their employees are located in Ukraine.

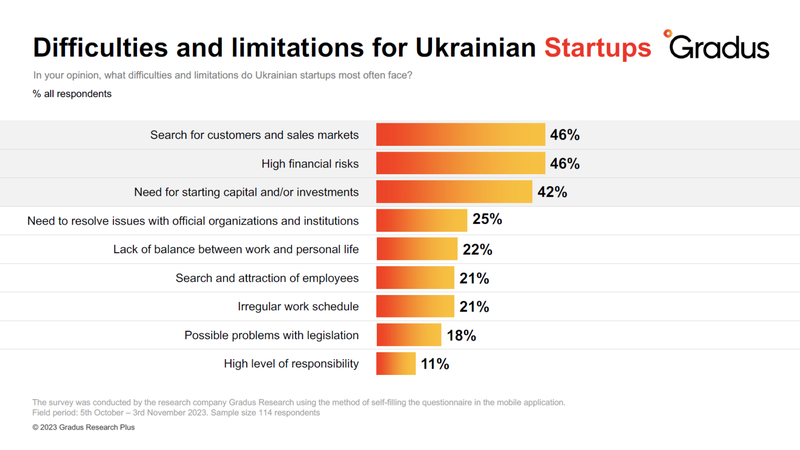

Main challenges: lack of orders, staff, and stability

For the surveyed Ukrainian startups, the key challenges are the search for customers and new markets (46%), as well as high financial risks (46%), which significantly affect the industry. 42% of respondents mentioned challenges in finding investments and securing initial capital.

Difficulties in organizing the workflow faced by young companies include the lack of orders (47%). For startups, the situation with finding orders has become more complicated due to the limited market. The second threat is the lack of highly qualified personnel (26%) due to migration caused by the war.

The biggest challenges for traditional businesses in Ukraine remain keeping the company fully operational (49%), maintaining current markets/customers (48%), keeping employees' remuneration at the maximum level (45%), and keeping them safe (43%).

Expectations about the duration of the war are growing, but businesses and startups are optimistic

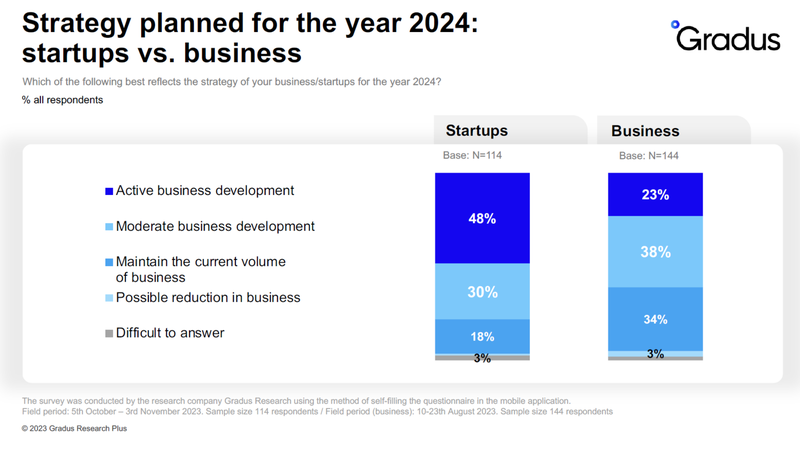

The survey results show that startups are more optimistic in their predictions about the end of the war in Ukraine: 54% of them believe that the war will end by the end of next year, compared to 38% of Ukrainian established businesses.

Nevertheless, both startups and Ukrainian businesses are active and plan to grow their business in the coming periods (48% of startups and 23% of businesses) and to grow their business moderately (30% of startups and 38% of businesses), which indicates high expectations for growth and success even in the face of war.

"Our surveys show that Ukrainian startups are more optimistic than traditional businesses and have a higher birth rate since the beginning of the war. And although startups are more dependent on finding funding, markets, stable communication infrastructure, or stable teams, even despite this volatility, they are more optimistic about their development strategies and assessment of the prospects for stabilization," says Evgeniya Bliznyuk, sociologist, founder and director of Gradus Research.

The full report on the survey results is available upon request in the form below.

The survey was conducted by Gradus Research using a self-administered questionnaire in a mobile application. Target audience of the survey: top management of Ukrainian startups, sample: 114 respondents, research period: October 5 - November 3, 2023. Target audience of research 2: top management of Ukrainian business, sample: 685 respondents, research period: October 5 - November 3, 2023.

Other reports

-

Fewer Donations, Unwavering Trust in the AFU, and Fears and Hopes Among UkrainiansFebruary 2026Special survey on the fourth anniversary of the full-scale invasion

Fewer Donations, Unwavering Trust in the AFU, and Fears and Hopes Among UkrainiansFebruary 2026Special survey on the fourth anniversary of the full-scale invasion -

How Perceptions of Relationships, Sex, and Valentine’s Day Are ChangingFebruary 2026Special survey for Valentine's Day

How Perceptions of Relationships, Sex, and Valentine’s Day Are ChangingFebruary 2026Special survey for Valentine's Day -

Stress in Europe and Ukraine: Young People’s Perceptions of LifeFebruary 2026International survey on the emotional state of young people, sources of stress, and attitudes toward work and life

Stress in Europe and Ukraine: Young People’s Perceptions of LifeFebruary 2026International survey on the emotional state of young people, sources of stress, and attitudes toward work and life -

Most Ukrainians are staying home despite blackoutsJanuary 2026Special survey on the impact of blackouts on Ukrainians' migration attitudes

Most Ukrainians are staying home despite blackoutsJanuary 2026Special survey on the impact of blackouts on Ukrainians' migration attitudes